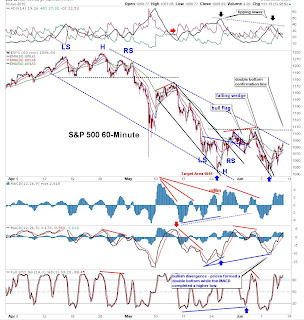

Well - as I said yesterday it looked pretty bearish - and today we got a gap down and just moved down. I have been saying this year that sell in may and go away was a good idea and that the summer 2010 will be pretty ugly. Until now these ones have been true. I still think we have more downside left and I really think we are not going to have any big rallies before near august/october, but we are traders and there will be small rallies. Everything looks pretty bearish now on all indicators only 5 min chart telling a little pop or gap up may come and then further selling. I took some short positions yesterday opening and sold some near close - I am in a lot of cash at the moment, only holding a few stocks. I am still very bearish longer term this markets and I think its much safer to be short than long. But again we are traders and its a "trader market", so for now staying cash until I see some better positive divergences I think we are going to see 950-960 level over next weeks and dont think july will be much better. If you go long - take the profits if you have them (no matter if its 1-5%) its still a bit and in this markets its better to take profits fast. We are NOT in a bull market and we turned into a bear market again as the MA(50) crossing the MA(200) very soon, which could lead do more downside.

Have a nice day and take care !